seattle payroll tax vote

City Council passes payroll tax. Companies with annual payroll of at least 7 million.

Bingo Amazon Is Getting Taxed The Stranger

This new tax must be paid by any Seattle organization for-profits and most.

. Councilmember Debora Juarez voted no and urged a public vote. The tax bill was adopted largely unchanged from the form in which it was voted out of committee last. The table below shows the applicable tax rates.

OThe tax is on businesses with 7 million or more Seattle payroll expense in prior year. In early July the Seattle City Council approved a payroll tax on companies by a 7-2 vote. The measure passed 7-2.

Payroll expense tax Beginning Jan. The move which went into effect Jan. On July 6 the Seattle City Council passed Jump Start Seattle Councilmember Teresa Mosquedas payroll tax legislation by a vote of 7-2.

The Seattle City Council is poised to pass a payroll expense tax package to fund Covid-19 relief and affordable housing at its 2pm meeting today. SEATTLE WA Seattle City Council has passed a progressive payroll tax on the citys largest businesses with a vote of 7 - 2. It is not imposed on the employee and is not a withholding from employees.

The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. In a 7-2 vote the council agreed to move ahead with the JumpStart Seattle plan which would be applied to businesses with 7 million or more in annual payroll. The full council is scheduled to vote on the measure.

SEATTLE WA Seattle City Council has passed a progressive payroll tax on the citys largest businesses with a vote of 7 - 2. For comparisons sake the JumpStart tax is anticipated to raise more than 200 million per year whereas Seattles current property-tax levy for affordable housing approved by voters in 2016. SEATTLE The Seattle City Council voted Monday to impose a new payroll tax on big businesses.

Pingback from City council fuels Seattles Green New Deal with JumpStart tax Crosscut Time July 15 2020 at 351 pm unanimous city council vote to use a slice of the revenue from the new JumpStart Seattle payroll tax to bring back the oversight board coordinator position represents momentum for the Green New Deal. While the ordinance has not yet been signed by the mayor as of publication the tax was passed by the council on July 6 2020 by a veto-proof majority 7-2 and is expected to become law effective January 1 20211. The full council is scheduled to vote on the measure.

AP The Washington state Legislature on Wednesday fast-tracked a delay of the implementation of. This new tax will be in addition to the Business Occupation BO taxes property taxes sales taxes and business license fees paid by Seattle employers. Payroll Expense Tax Effective Jan.

Seattles new tax on big businesses yielded more money than expected in its first year raising 231 million in 2021 to help the city address. The Seattle City Councils 7-2 vote in favor of the Seattle payroll expense tax indicates that the City Council could have overridden a veto from Mayor Durkan. Pingback from seattle payroll tax debacle could have national repercussions time january 26 2021 at 401 am northwest news nonprofit crosscut explains the seattle payroll tax which passed in july nicknamed jumpstart seattle by the city council that passed.

Money from the tax will initially be used to fund coronavirus relief but. Kevin Schofield In tax. This afternoon the City Council passed by a 7-2 vote the much-touted Jump Start Seattle payroll tax proposal with a couple of last-minute amendments.

Mosquedas plan raises less than half the revenues than. This tax targets big earners and the companies that employ them. SEATTLE The Seattle City Council voted Monday to impose a new payroll tax on big businesses.

Authored by Budget Chair Teresa Mosqueda. An assessment would not be. 07 tax on the payroll of employees with annual compensation between 150000 - 399999.

As expected the Council backed Council member Mosquedas Jump Start Seattle package rather than the Amazon Tax backed by Council members Sawant and Morales. OThe tax is imposed on the business. The Seattle City Council budget committee on Wednesday approved a tax on businesses and nonprofits with annual payrolls of 7 million more.

The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. Starting in January the City will tax companies with annual payrolls of 7 million or more at. The judgement comes after the Greater Seattle Chamber of Commerce contested the constitutionality of the tax which was passed by the City Council with a vote of 7-2 last summer on July 6.

Councilmember Alex Pedersen voted no and raised concerns about lost jobs. 1 2021 SMC 538 imposes a payroll expense tax on persons engaging in business within Seattle. Seattle Payroll Tax Vote.

On Monday July 6 2020 your Seattle City Council voted 7-2 to approve a new tax on large Seattle employers Council Bill 119810. As shown in the table above for businesses with annual Seattle payroll expense greater than 7 million either a 7 or 14 tax rate. 1 2021 the Seattle payroll expense tax is imposed using a three-tier structure determined by annual business revenue and level of employee compensation.

This afternoon the City Council voted out of committee a proposed payroll tax setting it up for final adoption next Monday. 1 exacts a 07 tax on payroll 150000 and over for businesses with annual payrolls of 7 million or. Called the JumpStart Seattle tax the bill passed late Monday on a 7-2 vote and is expected to go into effect in 2021.

The Seattle City Council took a major step Wednesday toward adopting a new tax on big businesses voting in a budget committee meeting to advance a proposal expected to raise more than 200. As amended the tax will raise 214 million per year. That margin makes it veto-proof an important note considering that.

Dubbed JumpStart Seattle the legislation passed budget committee on Wednesday on a 7-2 vote with Councilmembers Alex Pedersen and Debora Juarez the nays. Revenue generated will help the City cover COVID-19-related costs in the short term and to create affordable housing in later years.

Seattle S Big Business Tax 1 Year Later Controversial Policy Generates Unexpected Surplus Geekwire

Council Connection Strong Concerns About Imposing New Taxes On Seattle Employers During Recession

Progressive Tax On Business Council Seattle Gov

Seattle Adopts Spending Plan For New Payroll Tax On Big Business Geekwire

Seattle A Step Away From Approving New Progressive Revenue Tax On Big Businesses To Help Overcome Covid 19 Budget Crisis Chs Capitol Hill Seattle

How Amazon Killed Seattle S Head Tax The Atlantic

Council Uses Jumpstart Payroll Tax To Fuel Big Affordable Housing Investments In 2022 Budget The Stranger

Would You Sign The Repeal The Head Tax Petition In Seattle Quora

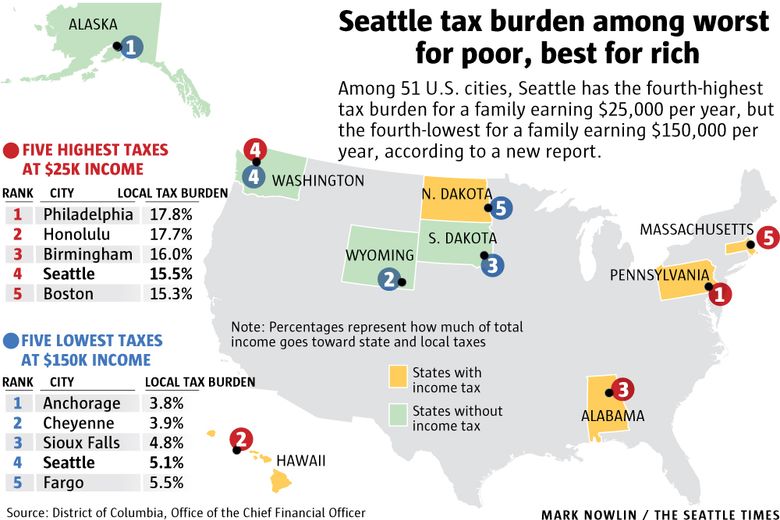

Opinion Tax Foundation Seattle Times Highlight Capital Gains Income Tax Advisory Vote Clarkcountytoday Com

Seattle Passes Smaller Head Tax On Amazon And Other Big Companies After Impassioned Debate Geekwire

City Council Completes Framework For Seattle S New Tax On Largest Companies With Fund For Housing Small Business Green New Deal And Equitable Development Chs Capitol Hill Seattle

In Most Regressive State Seattle Passes Tax On Highest Incomes The Two Way Npr

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Kuow Seattle Just Voted For A Shrunken Head Tax

To Pacify Amazon Seattle Takes Less From A Tax On Big Business That Will Help The Poor South China Morning Post

Bingo Amazon Is Getting Taxed The Stranger

Amazon Payroll Subject To New Seattle Tax And Jeff Bezos Is Wealthier Than Ever Washington Business Journal

Seattle S New Payroll Tax Is A Gamble Seattle Met

Seattle Taxes Among Nation S Kindest To The Rich And Harshest To The Poor The Seattle Times